Strategy Builder — Product Manual

Oct 8, 2025

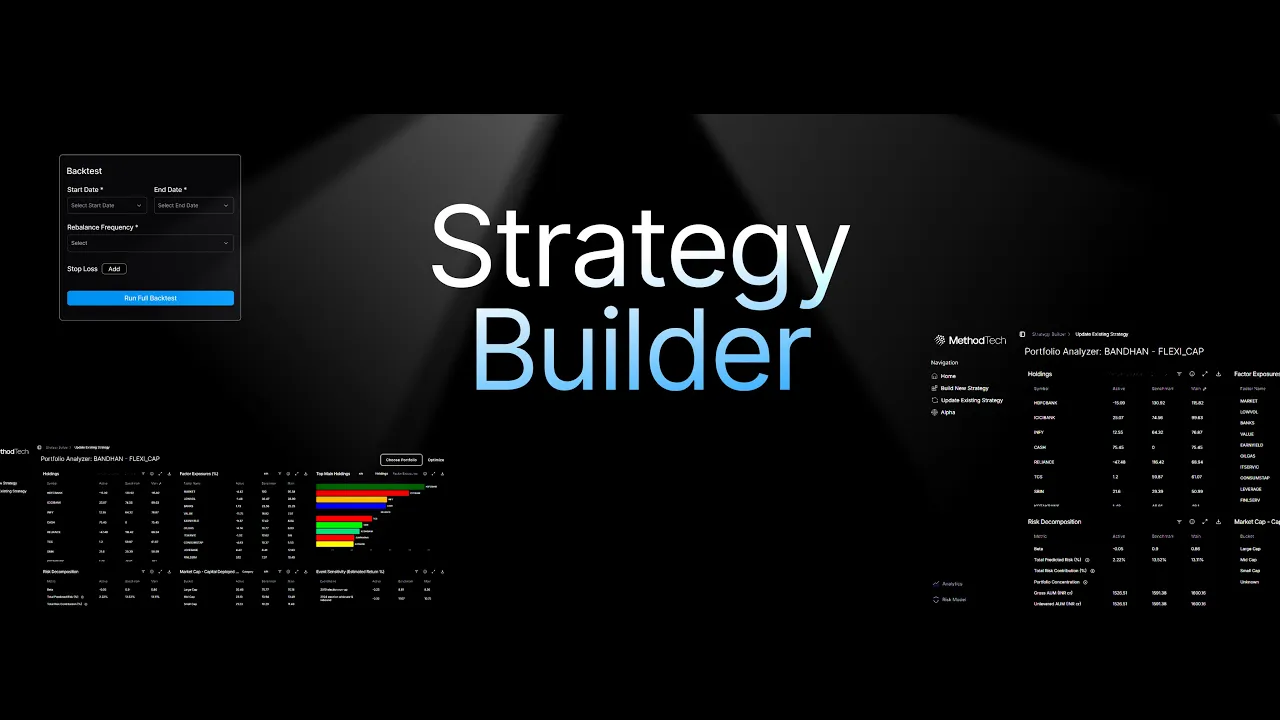

What is Strategy Builder?

Strategy Builder is a component of MethodTech’s SaaS platform for institutional asset managers, analysts, and portfolio teams to design, backtest, and deploy investment strategies through an intuitive interface with surgical precision. It supports both quantitative and fundamental approaches, enabling data‑driven decisions with rigorous testing.

Whether you are constructing a factor‑based equity strategy or refining a fundamental portfolio with quant overlays, Strategy Builder provides the infrastructure to iterate, validate, and operationalize investment ideas.

What are some use cases?

Fundamental Portfolio Enhancement

Add a quant overlay on fundamental ideas, constructing a risk‑managed portfolio that preserves intended alphas and minimizes unintended exposures.

Example: Start from analyst picks; set Factor Exposure Constraint to keep Value/Size/Momentum near zero; add Position Size Bounds tighter for Small Caps; run 1‑Day Results to verify exposures, then backtest.

Fundamental Portfolio Enhancement

Build and backtest strategies from scratch using risk‑model factors, MethodTech proprietary alphas, or user‑uploaded alphas. Portfolio‑construction features support intentional, optimal target portfolios.

Example: Long‑only tilt with Alpha Objective (MethodTech Quality alpha), Benchmark Tracking (Total TE), Turnover Constraint (monthly 20%), and Beta cap at 0.95–1.05.

Portfolio Review

Upload a candidate portfolio, gather team inputs, make real‑time edits, and view forward‑looking insights before going to production.

Example: Update Existing Strategy → Select Portfolio, set Active mode for risk/β constraints vs benchmark, and check attribution before publishing.

Workflow

A) Build New Strategy

Steps:

From the Home page, select Strategy Builder (bottom‑left of the left navigation).

Click Build New Strategy in the navigation bar.

Click Build Strategy (top‑right) to open the configuration drawer.

Complete the top section (Basics):

Fund Name — project/fund name (alphanumeric).

Scheme Name — strategy name within the fund/project (alphanumeric).

Iteration Name — version tag for research variations (alphanumeric). Tip: Use a clear convention (e.g., 2025‑10‑06_qm_valqual_v3).

Universe — select the allowed stock universe (choose from presets).

Why: Keeps names investable and controls liquidity.Performance Benchmark — for performance and risk/TE tracking; can differ from the universe.

Why: Enables Active constraints/objectives and attribution.

Date — pick a specific date to sample the strategy.

Use: Quick plausibility checks across a few dates.Include futures instruments — toggle On to allow futures.

India note: Only futures can be shorted—required for long/short.

Configure Rules (middle section):

The core strategy building part is done by setting up rules (constraints and objectives) on how the portfolio should be constructed each day.

Constraints — strict limits (e.g., Maximum Capital, Position Size, TE/β, Factor, Turnover, Liquidity).

Objectives — preferences (e.g., Alpha, Tracking, Risk, Costs, GMV).

A detailed overview of each constraint and objective is included in the appendix to this document.

Backtest:

Once your strategy is set up, we recommend the following workflow:

1‑Day Results — Select a date from the top section, and click on “Compute 1-Day Results”. This will generate a portfolio based on your rules for the given date and produce a set of analytics that will allow you to inspect if the output portfolio is representative of your intentions. It can be used to refine the portfolio construction rules in a quick, iterative process.

Backtest (in‑sample) — Second, pick a date range to run an in-sample backtest. This can be done via the “Configure Backtest” button. It opens a pop-up that allows you to select a start and end date for your backtest, along with a rebalance frequency. We also allow an option to add a stop loss. In the event of a certain percentage (fed by the user) of the portfolio hitting the top loss, the full portfolio rebalances. Then click “Run Full Backtest” to initiate the backtest. Once the backtest results are available, you can go to the “Home” page of strategy builder and click on the “Analytics” link in the status table to see detailed analytics for the backtested portfolio. Use these analytics to derive insights, refine your strategy, and repeat.

Out‑of‑sample confirmation — clone with a new Iteration Name; keep rules identical. This workflow is a great way to make sure you are not overfitting to some specific period, and exponentially increases the chance of real-life portfolio performance reflecting backtested results.

Sanity checklist before publishing

Exposures within bands; β in range; TE as targeted.

Position sizes feasible vs ADV; turnover consistent with mandate.

Attribution lines up with intent (alpha source matches thesis).

No unexpected concentration at the sector/industry bucket level.

B) Update Existing Strategy

Steps:

From Home, open Strategy Builder → Update Existing Strategy and click Choose Portfolio.

Choose one:

Select Portfolio — pick a public/example or previously upload portfolio; set an Initial Date to import that day’s holdings and analytics.

Upload Portfolio — upload a one‑day portfolio; provide Fund, Scheme, Benchmark, and Date.

Initial metrics are generated for the selected date.

Click Optimize (top‑right) to open the rules drawer and modify the portfolio.

Differences vs Build New Strategy:

Benchmark is inherited from the selected/uploaded portfolio.

Toggle Include existing holdings so the new universe is a superset of current names + preset.

Backtest is available only with Select Portfolio (history present); a one‑day upload cannot be backtested.

Appendix

Constraints

A) Maximum Capital (required)

Defines initial capital and guardrails.

Constraint Name — any meaningful alphanumeric string.

Maximum Capital (₹ Cr) — initial deployed capital.

Minimum cash (%) — floor on cash holdings.

Maximum Leverage — e.g., 1 = no leverage; 4 = exposures up to 4× capital (ex‑cash). Applies when Include futures instruments = On.

Maximum Net Notional (₹ Cr) — net exposure limit.

Long‑only → set equal to Maximum Capital (default).

Perfect long/short → set ≈ 0.

SIF‑style (up to ~25% shorts) → set ≈ 50% of Maximum Capital.

Required: set in every portfolio.

Examples:

Long‑only, no leverage: Max Capital = ₹10 Cr, Min cash = 5% ⇒ at least ₹0.5 Cr cash always; Max Net Notional = ₹10 Cr.

SIF‑style (25% shorts): Max Capital = ₹20 Cr, Max Leverage = 1 (long‑only) but allowing shorts via futures; set Max Net Notional ≈ ₹10 Cr (≈50% of Max Capital) to target ~75% longs / 25% shorts.

Perfect L/S: Max Capital = ₹10 Cr, Max Leverage = 2, Max Net Notional ≈ 0 ⇒ longs ≈ shorts (gross ≈ ₹20 Cr), net close to 0.

Common pitfalls:

Setting Max Net Notional inconsistently with the intended long/short profile.

Using Leverage > 1 without turning Include futures instruments on (shorts won’t materialise).

B) Position Size Bound

Caps per‑name exposure

Dimension — % of Notional, % of Volume (ADTV‑63), or % of Market Cap.

Scope — Total or Active vs Benchmark (over/underweight bands).

Defaults — Lower/Upper % for all names (lower bound must be 0 for long‑only).

Overrides — Category → Bucket (e.g., Small Caps 0–3%) and Per‑stock (ticker‑level). Click Add for each override.

Illustrative setup

Defaults: 0–5% per name (of notional).

Category override: Market Cap → Small Cap = 0–3% to respect liquidity.

Per‑stock override: A large‑cap with known crowding risk = 0–2% to reduce concentration.

Active‑vs‑Benchmark example

If the Benchmark weight in Stock X is 5% and you set Active bounds = −2% to +2%, the final portfolio weight must be between 3% and 7%. The same logic applies if your dimension is Volume or Market Cap instead of Notional.

C) Portfolio Risk Budget Constraint

Bounds predicted (ex‑ante) risk from the risk model

Constraint Name - any meaningful alphanumeric string.

Risk Type & % — choose Total, Idiosyncratic, or Factor; set % as max annualized volatility (as % of Maximum Capital).

Active mode — when Active is selected (top‑right), the bound is applied relative to a chosen benchmark.

Scales risk down in high‑vol regimes and up in calmer regimes.

D) Beta Exposure Constraint

Caps portfolio beta

Constraint Name - any meaningful alphanumeric string.

Max Beta (%) — 100 = β≤1; 0 = market‑neutral; other values as needed.

Active mode — In the top-right of the pop-up, there is a button called “Active”. When selected, the constraint is applied not on the total portfolio, but on the Active portfolio relative to a benchmark of your choice (you have to specify this via a dropdown). The bounds then become relative to the benchmark exposure, rather than in absolute space.

E) Factor Exposure Constraint

Limits exposure to specific factors

Constraint Name - any meaningful alphanumeric string.

By Factor — select individual factors and set Lower/Upper bounds as % of gross notional (= Maximum Capital × Maximum Leverage).

By Factor Group — set one bound applied to each factor within a group (e.g., Industry).

Click Add Factor.

Active mode — In the top-right of the pop-up, there is a button called “Active”. When selected, the constraint is applied not on the total portfolio, but on the Active portfolio relative to a benchmark of your choice (you have to specify this via a dropdown). The bounds then become relative to the benchmark exposure, rather than in absolute space.

F) Sub‑Portfolio Capital Constraint

Sets min/max capital for a chosen sub‑portfolio (long‑only)

Constraint Name - any meaningful alphanumeric string.

Category & Bucket — e.g., Market Cap → Small Cap.

Lower/Upper (% of gross notional) — These are expressed as percentages of the total gross notional (max capital x max leverage). For instance, if lower and upper bounds are set at 25 and 45 for Category = Market Cap and Bucket = Small Cap, when the maximum capital is 10 crores and max leverage is 1, it means that the solver will deploy at least 2.5 crores in small-cap names, and no more than 4.5 crores. Click Add Category‑Bucket for each rule.

Active mode — apply relative to the benchmark’s capital distribution.

G) Single Name Idiosyncratic Contribution

Bounds idiosyncratic (stock‑specific) risk contribution per name

Constraint Name - any meaningful alphanumeric string.

Total Risk Budget (%) - The target maximum total risk allowed in the portfolio.

Max Portfolio Idiosyncratic Contribution (%) - The maximum percentage contribution of overall idiosyncratic risk to overall risk.

Lower/Upper (% per name) - The minimum and maximum idiosyncratic risk contribution allowed by any single name.

Non‑convex in theory; implemented via approximation, so quadratic programming solves efficiently and remains close to the target.

H) Portfolio Turnover Constraint

Caps turnover

Constraint Name - any meaningful alphanumeric string.

Turnover % — provide Daily / Monthly / Yearly; others auto‑derived. Please note: if you want your portfolio to turn over no more than 2 times each year, set the yearly value to 200.

Excludes unscheduled rebalances (e.g., stop‑loss events), so realized turnover can exceed target during those periods.

Objectives

A) Benchmark Tracking

Penalize deviations from a benchmark by minimizing risk between portfolio and benchmark holdings

Benchmark

Objective Name - any meaningful alphanumeric string.

Tracking Type — Total, Idiosyncratic, or Factor risk to minimize.

Objective Weight — relative preference (click Add Tracking Type after selection).

B) Risk Minimization Objective

Minimize chosen risk type to ensure risk‑aware outputs

Objective Name - any meaningful alphanumeric string.

Risk Type — We allow you to specify this along three different dimensions (Total, Idio, and Factor). “Total” means the overall portfolio risk (Idio + Factor), “Idio” means Idiosyncratic (stock specific) portion of the risk, and “Factor” means the risk attributable to the risk model factors.

Objective Weight

C) Factor Exposure Minimization Objective

Minimize exposures to chosen factors

Objective Name - any meaningful alphanumeric string.

We provide two convenient options to specify this objective:

By Factor: when this option is selected, you can select individual factors from the dropdown menu and specify an objective weight.

By Factor Group: This is a convenience option that allows you to set a single objective weight that applies to each factor within a factor group.

Remember to click on “Add Factor” once you’ve selected a factor and added the bounds.

Active mode — minimize exposures relative to a benchmark when Active is selected (on the top-right corner). The minimization term then becomes relative to the benchmark exposure, rather than in absolute space.

D) Alpha Objective

Maximize exposure to alpha signals of your choice

Objective Name - any meaningful alphanumeric string.

Standard Alpha — choose from MethodTech’s standard alphas; set Objective Weight.

User Created Alpha — choose from uploaded alphas; set Objective Weight.

Click Add after each specification (multiple alphas supported).

E) Factor Alpha Objective

Maximize exposure to a risk‑model factor of choice

Objective Name - any meaningful alphanumeric string.

Select Factor Alpha — choose factor; set Objective Weight; click Add. You can add as many alphas as you’d like with different objective weights in one go.

F) Maximize GMV

Maximize capital usage (minimize cash). Long portfolios only

Objective Name - any meaningful alphanumeric string.

Objective Weight